Regulated and Security

Protecting the Financial Sector

Safeguarding financial institutions and consumers from fraud and impersonation.

Purchasing behavior has evolved and convenience often comes above price. But fraud and impersonation threaten consumer confidence and trust is more precious than ever.

Around half of consumers value convenience over price or cost savings. In addition, 90% reference convenience within payment as a major influence on spending decisions. With the explosive growth in online commerce and a premium on frictionless transactions, payment cards and online payment services offer the flexibility for where and how purchases are made. In fact, payment cards alone now account for over half of retail transactions.

Card fraud costs over $30 billion annually, with 54% of financial institutions and 46% of FinTech companies encountering counterfeit documents in 2022.

However, as consumers embrace convenience and online transactions, they become exposed to a wider range of threats. Attacks against the financial sector represented around 28% of all phishing scams in 2022 and 65% of transaction card holders have experienced credit card fraud. Protecting consumer confidence, minimizing risks to financial institutions, and protecting the integrity of iconic payment brands requires a multifaceted response.

Resolving multiple challenges requires a multi-layered approach to security.

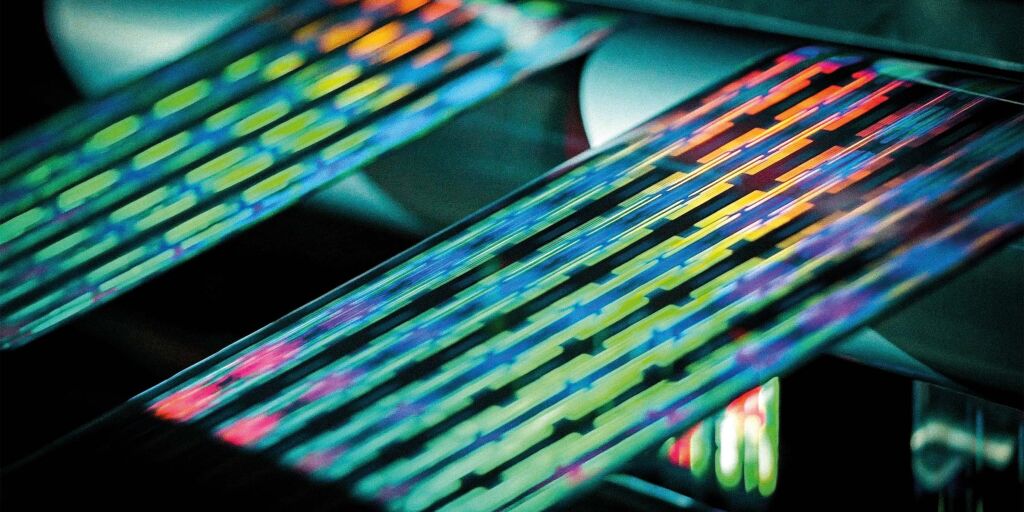

Credit card cloning may continue to rise, but protecting the physical card itself from counterfeiting remains critical. For many card issuers, a secure and distinctive optical security feature is a long-standing anti-counterfeit component and is often the only brand marque visible on a card. For determined online fraudsters that imitate trusted financial brands, sophisticated digital detection and swift enforcement responses are equally essential.